The IRS has announced the 2022 income tax tables and other adjustments for inflation. Plan ahead to lower your 2022 income taxes and lower lifetime taxes through multi-decade tax planning impacting Roth conversion strategies, the sale of major assets, passing down family businesses, or dealing with Required Minimum Distributions.

How Today's and Future Inflation Impacts Your Retirement

Inflation is an insidious beast, and it’s surprisingly more dangerous than a market crash.

How would a slight increase in expected inflation impact your retirement plans? For the vast majority of my clients, inflation is the single biggest concern when stress testing the analysis and statistical models of their retirement plan.

Why Today's Inflation Isn't the Hyperinflation of the 70s

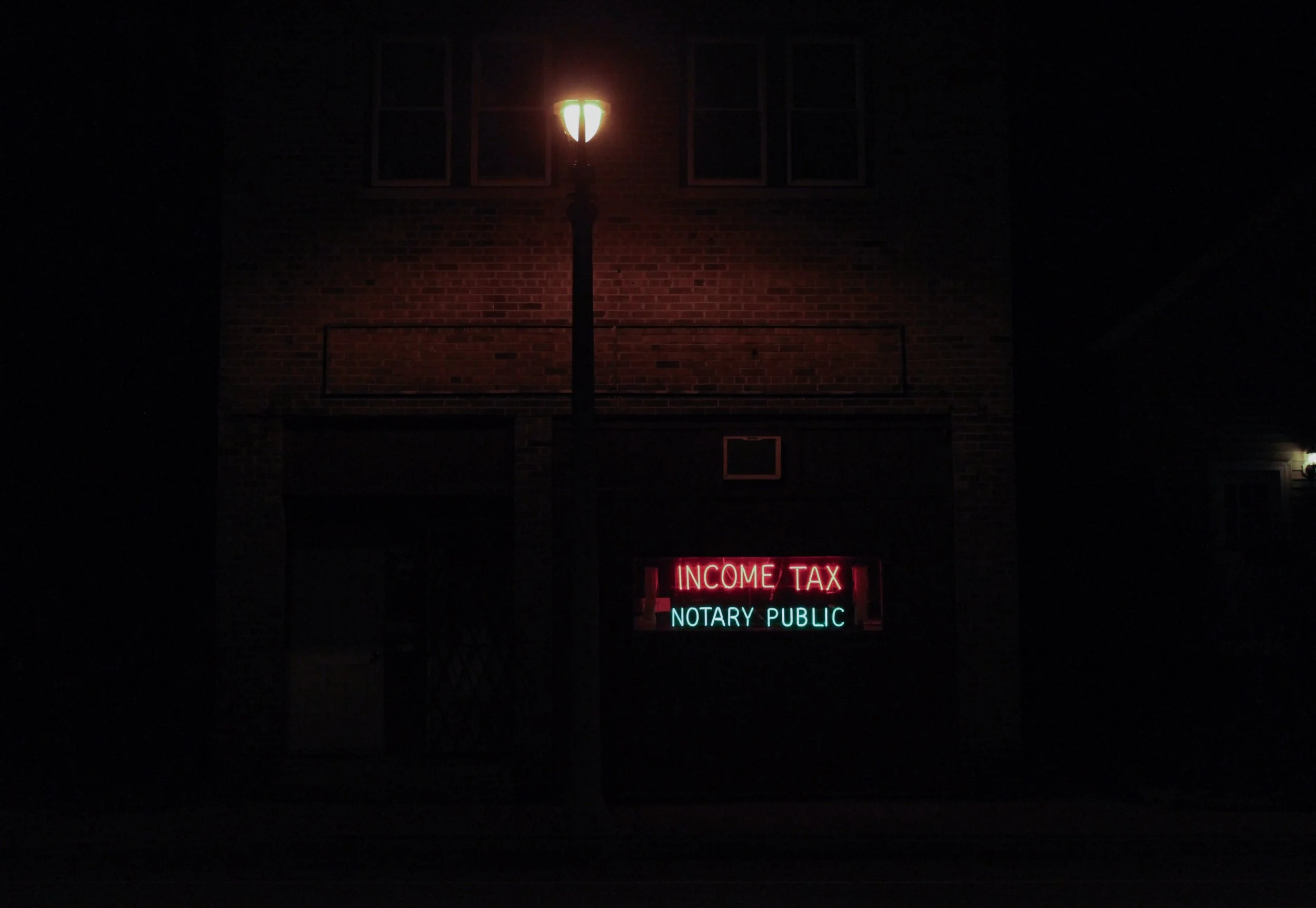

IRS 2022 Tax Tables, Deductions, & Exemptions

The IRS has announced the 2022 income tax tables and other adjustments for inflation. Plan ahead to lower your 2022 income taxes and lower lifetime taxes through multi-decade tax planning impacting Roth conversion strategies, the sale of major assets, passing down family businesses, or dealing with Required Minimum Distributions.

IRS 2021 Tax Tables, Deductions, & Exemptions

The IRS has announced the 2021 income tax tables and other adjustments for inflation. Plan ahead to lower your 2021 income taxes and lower lifetime taxes through multi-decade tax planning impacting Roth conversion strategies, the sale of major assets, passing down family businesses, or dealing with Required Minimum Distributions.

Racial Justice: Don't ask 'What Can I do?' . . . say 'What I Can Do Is'

IRS 2020 Tax Tables, Deductions, & Exemptions

The IRS has announced the 2020 income tax tables and other adjustments for inflation. Plan ahead to lower your 2020 income taxes and lower lifetime taxes through multi-decade tax planning impacting Roth conversion strategies, the sale of major assets, passing down family businesses, or dealing with Required Minimum Distributions.

Would Getting a Paper Divorce Help Financially?

What should I do with my old 401(k) from a previous employer?

Understanding Credit & Strategies for Improving Your Credit Score

Is Social Security Income Taxable?

5 Ways The SEC Says "Screw You" to Investors with Regulation Best Interest

The recent approval of the SEC’s Regulation Best Interest (Reg BI) has killed any hope that financial advisers at Broker/Dealers would finally be required to be fiduciaries for their clients. The SEC went out of its way to create a regulation that would confuse consumers into thinking they have legal protections, when they don’t.